Writer: Felipe Rivas

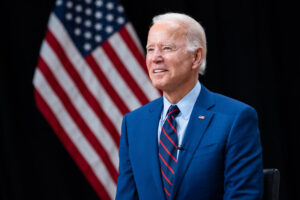

3 min read March 2021 — The presidential election season throughout 2020 added yet another layer of complexity to Charlotte’s local business ecosystem, especially as industry leaders focused on navigating the COVID-related challenges. With President Joe Biden now at the helm, the potential repeals of the previous administration’s policies or total adoption of new federal policies is something industry leaders across sectors are keeping a close eye on. From tax and wealth planning to construction, Invest: asked Charlotte’s leaders to weigh in on what the Biden administration could mean for their industries.

3 min read March 2021 — The presidential election season throughout 2020 added yet another layer of complexity to Charlotte’s local business ecosystem, especially as industry leaders focused on navigating the COVID-related challenges. With President Joe Biden now at the helm, the potential repeals of the previous administration’s policies or total adoption of new federal policies is something industry leaders across sectors are keeping a close eye on. From tax and wealth planning to construction, Invest: asked Charlotte’s leaders to weigh in on what the Biden administration could mean for their industries.

John Norman, Managing Partner, GreerWalker LLP

The No. 1 driver and No. 1 question from all our clients is what is going to happen to tax rates, and the potential for retroactivity. That is our top focus. We don’t have a crystal ball, but based on our long-standing experience, there is unlikely to be major tax legislation in 2021. There are too many competing priorities, added to a tied Senate. To our knowledge, the Trump Tax Act was the first time we ever saw anything become retroactive. Everything else was prospective. 2021 is going to be focused on what is likely to come. Biden’s platform when he was a candidate did not include tax legislation on his official website.

Malcomb Coley, Central Region EY Private Leader & Charlotte Managing Partner, EY

Malcomb Coley, Central Region EY Private Leader & Charlotte Managing Partner, EY

There is a greater need for unity across a number of different sectors. The new administration brings a fresh sense of what America is all about, its founding principles and getting back to that community aspect of what the country should be. We are cautiously optimistic as we move forward.

Andy Brincefield, President & CEO, Consolidated Planning

The SEC implemented several changes in 2019 and again 2020. We anticipate there will be more SEC changes over the next two years that address pending Department of Labor issues with retirement plans, which are relevant from a financial planning perspective. The Trump administration repealed several elements on these fronts and they will come back under the Biden administration. Overall, we’ve had less federal regulation in the last four years, along with significant pullback and freezing of certain regulations. In that vacuum, states have stepped in with their own regulations.

Dan Warren, Charlotte Market Leader, Elliott Davis

Part of our job is looking ahead and seeing what our clients need and how legislative changes impact them. We are continuously in the loop in terms of new developments related to tax policy and regulations. There is a possibility that tax rates could be going up. The questions are when that would be kicking in and how does it affect tax planning and strategies for our clients. We are having a lot of those conversations with clients right now

Chris Frye, Co-Founder & Partner, Barringer Construction

We’re not really sure. So far, we’re just waiting to see what happens and follow our customers’ lead. Essentially, I think everyone here is yearning for some normalcy after what has been a pretty hectic year. Our expectations for society as a whole are to reconnect, following a year where everyone seemed to become so polarized and divided. Despite which administration is in office and how we as individuals feel about it, we need to do our part to meet in the middle now more than ever.

To learn more about our interviewees, visit:

Photo Credit: https://www.whitehouse.gov/