Growing a tech hub

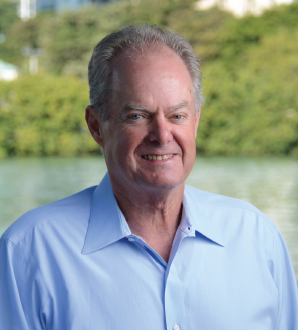

Medina CapitaManaging Partner and eMerge Americas Conference creator Manuel D. Medina discusses Miami’s budding tech industry What were the origins of eMerge Americas and the movement to build a tech hub in Miami? The idea grew out of my frustrations in running a publicly traded tech company, Terremark, headquartered in