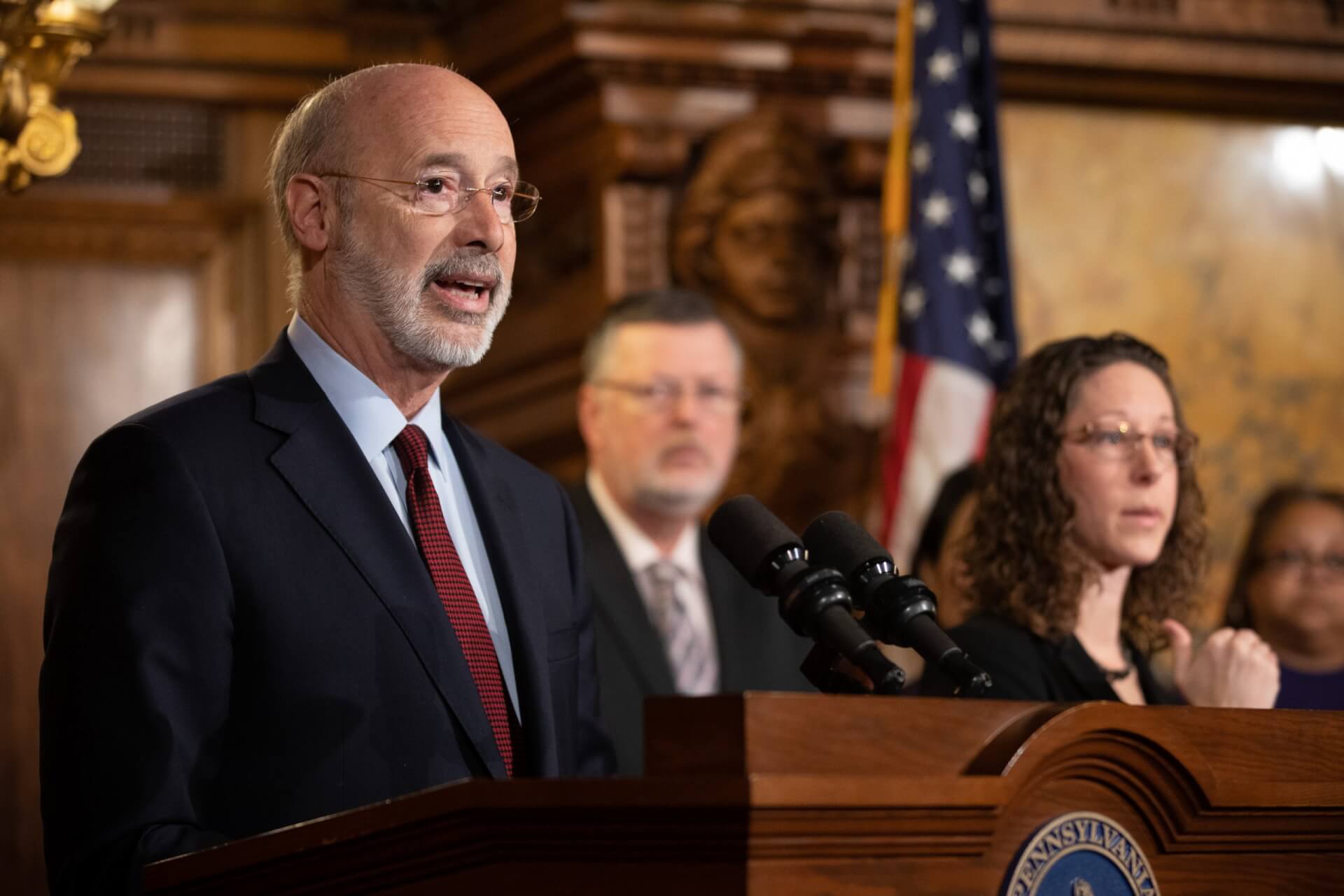

Gov. Wolf’s Pennsylvania Budget Prioritizes Education, Income

By: Sara Warden 2 min read February 2020 — Democrat Gov. Tom Wolf focused his 2020-21 budget on education and income, proposing an increase in spending of almost 6% to $34 billion over the fiscal year, including $600 million to cover cost overruns. Republicans criticized the heavy reliance of the budget on